Exploring Business: Business strategies and market insights.

Introduction and Outline: Why the Economy Shapes Everyday Choices

Everyday life is an ongoing negotiation with the economy. The price of a morning coffee, the salary offered in a job posting, the rent on an apartment, and the yield on a savings account are all guided by forces that link people, firms, and institutions into a living system. When income rises, demand shifts. When a storm disrupts harvests, supply contracts. When policymakers adjust interest rates, the cost of borrowing and the value of saving change. Understanding these dynamics does not require a degree; it requires curiosity and a practical framework. This article bridges concepts to decisions, turning headlines into navigational aids for workers, entrepreneurs, and households.

To help you find the signal amid the noise, here is the outline we follow:

– Prices, Demand, and Supply: How markets signal scarcity and abundance, with real-world scenarios you can recognize on store shelves.

– Business Strategy: How organizations compete through cost, uniqueness, and focus, and why strategy must align with market structure.

– Money, Credit, and Investment: How savings become capital, how interest rates ripple through budgets, and how to think about risk and return.

– Conclusion and Practical Takeaways: Clear actions for consumers, workers, and entrepreneurs drawn from the preceding insights.

Why this matters now is straightforward. The last few years have highlighted how interconnected the world has become: supply chains stretch across continents, digital platforms accelerate competition, and technology reshapes roles at work. Prices in one sector can influence costs elsewhere; for instance, energy shifts can alter transportation and food expenses. At the same time, productivity gains and innovation can improve living standards and open new markets. To navigate this landscape, readers benefit from a balanced understanding—one that recognizes constraints and trade-offs while identifying opportunities to build resilience.

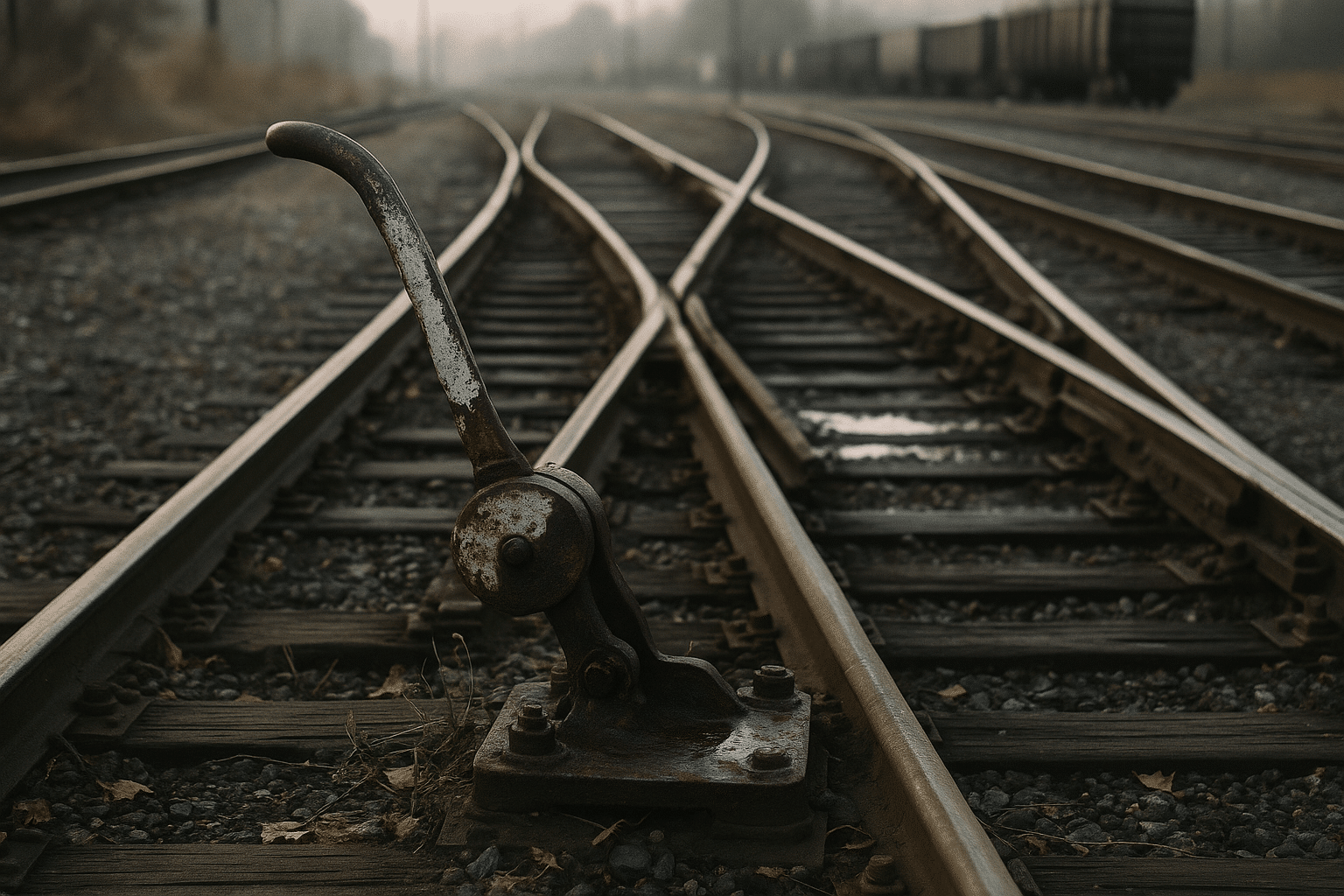

Think of the economy as a river system. Tributaries (households and firms) feed into a main current (markets and institutions). Seasonal changes (policies and global events) raise or lower the waterline. The wise traveler studies the flow, prepares for eddies, and uses the current. With that image in mind, let us move from the map to the journey.

Prices, Demand, and Supply: How Markets Signal Scarcity

At the heart of market activity is the price system—a decentralized signal telling buyers and sellers when to advance or retreat. When a good becomes more expensive, buyers tend to purchase less and suppliers strive to produce more; when it becomes more affordable, the inverse happens. This dynamic reflects two classic relationships: the downward-sloping demand curve and the upward-sloping supply curve. Where they meet—equilibrium—sets the prevailing price and quantity. While reality is never a perfect graph, the framework illuminates why shelves fill or empty and why your budget stretches or tightens.

Consider elasticity, the measure of how sensitive quantity is to price changes. If a 10% price increase leads to only a 5% drop in purchases, demand is inelastic (elasticity magnitude less than one). Many essentials—basic utilities or staple foods—often show lower elasticity in the short run, as people cannot easily substitute them. Conversely, non-essentials or products with many substitutes tend to be more elastic. This matters for both households and firms: it informs how families prioritize spending and how businesses price products to sustain revenue without losing too many customers.

Supply is shaped by technology, input costs, expectations, and regulation. A sudden disruption—say, a poor harvest—can shift supply leftward, lifting prices even if demand doesn’t change. A productivity improvement—such as more efficient logistics—shifts supply rightward, reducing prices or raising quantities. The ripple effects can be far-reaching; for example, a shift in energy costs often affects transportation, which in turn influences everything from fresh produce to construction materials.

Real-world examples illustrate the point:

– Weather shocks can tighten agricultural markets, pressuring food prices and household budgets.

– Innovation can lower production costs, allowing firms to offer more features at the same price or maintain margins at lower prices.

– Expectations about future prices may prompt businesses to stockpile inputs, temporarily elevating demand and prices today.

Markets differ in structure as well. In highly competitive settings, no single seller can meaningfully move prices; in concentrated industries, pricing power can be greater, particularly when products are differentiated. For consumers, this suggests paying attention to alternatives and timing purchases; for firms, it signals the importance of cost control and product positioning. A practical takeaway: when you see a price move, ask which side of the market moved and why—supply contraction, demand surge, or both—and what that implies for your next decision.

Business Strategy: Competing Through Cost, Differentiation, and Focus

Strategy is how an organization chooses to win. Among the widely applied approaches are cost leadership (making efficiently to offer lower prices), differentiation (offering distinctive features or experiences), and focus (serving a specific niche deeply). Each approach must align with the firm’s capabilities and the market’s structure. A small regional producer may thrive by focusing on local tastes and proximity, while a larger operation might leverage scale to drive unit costs down.

Consider cost leadership. The goal is to produce at lower average cost than rivals without sacrificing reliability. Tactics include optimizing processes, negotiating input costs, and reducing waste through lean operations. Yet cost advantage is not simply a race to the lowest price. The durable edge comes from a system of mutually reinforcing activities—efficient procurement, standardized components, and streamlined distribution. The key risk is a “race to the bottom,” where quality erodes; thus, effective cost leaders devote care to what must not be trimmed.

Differentiation relies on uniqueness valued by customers. This could be superior durability, elegant design, faster service, or trusted after-sales support. The art here is to avoid features that inflate costs without adding perceived value. Firms often use customer insight—surveys, interviews, usage data—to map what truly matters. In markets where switching costs are low and comparisons are easy, clarity about the value proposition is essential.

A focus strategy blends elements of cost and differentiation for a well-defined segment. For example, a service provider might specialize in a particular industry’s compliance requirements. By narrowing scope, the firm builds deeper expertise, which can yield both higher perceived value and lower delivery costs through repeatable processes.

Choosing among strategies depends on context:

– In fragmented markets with many small players, focus can be an efficient path to standing out.

– In standardized markets where scale matters, cost leadership may be compelling.

– In markets with varied preferences and low switching costs, differentiation becomes central.

Measurement grounds strategy in reality. Unit economics—revenue per unit minus variable costs per unit—should be positive and scalable. Contribution margin indicates how much each sale contributes to covering fixed costs and profit. Payback period and customer lifetime value help evaluate marketing and service investments. As conditions change—new entrants, evolving technology, shifting regulations—firms must revisit positioning. Adaptation is not a sign of weakness; it is a sign of strategic learning.

From time to time, market insight arrives like a change in the wind: a small shift in customer behavior today foretelling next year’s demand. Organizations that listen closely—through diligent research and continuous feedback—are positioned to tack smoothly rather than be caught broadside.

Money, Credit, and Investment: From Household Budgets to Capital Allocation

Finance is the connective tissue of the economy, moving resources from savers to borrowers. Households save for education, homes, and retirement; firms borrow or raise equity to fund projects; public entities issue debt to build infrastructure and provide services. Interest rates are the economy’s tempo—alter them, and the rhythm of borrowing and saving quickens or slows. When the cost of borrowing rises, households may delay major purchases and firms may defer expansions; when it falls, credit often flows more freely, stimulating activity.

For households, a basic framework helps:

– Build an emergency reserve to cushion shocks; even a few months of expenses can meaningfully reduce financial stress.

– Distinguish between productive debt (financing assets that generate value over time) and burdensome debt (high-cost borrowing for short-lived consumption).

– Use a simple budget to prioritize essentials, savings, and measured discretionary spending.

For businesses, capital allocation is about deploying scarce resources where risk-adjusted returns are strongest. Tools like net present value (comparing today’s cost with discounted future benefits) and internal rate of return (the discount rate that sets NPV to zero) support decisions. While formulas are helpful, assumptions matter more: cash flows, timing, and risk must be realistic. Diversification across projects and customers can reduce volatility at the company level, just as diversified portfolios reduce volatility for investors.

Inflation, the gradual rise in prices over time, erodes purchasing power. A nominal return of 4% in an environment of 3% inflation leaves just 1% in real terms. For savers and investors, seeking returns that at least preserve real purchasing power is a sensible anchor. For firms, pricing strategies must reflect input costs, competitive dynamics, and customer tolerance; frequent small adjustments often work better than infrequent large ones, which may shock demand.

Risk management improves resilience. Scenario planning—asking “What if revenue falls by 10%?” or “What if input costs rise by 15%?”—exposes vulnerabilities. Stress tests around liquidity, debt service, and inventory buffers can reveal whether a business can withstand common shocks. Households can simulate the effect of income changes and unexpected expenses to guide insurance choices and savings goals.

Over the long run, productivity growth—the ability to do more with the same inputs—supports rising living standards. Investment in skills, processes, and technology fuels this growth. Though results compound slowly, they compound reliably: consistent improvements in efficiency, quality, or customer satisfaction can reshape outcomes over time. Finance, put simply, is the way we trade today’s certainty for tomorrow’s possibility.

Conclusion: Practical Takeaways for Consumers, Workers, and Entrepreneurs

Economic knowledge becomes powerful when it informs everyday choices. Whether you are managing a household, planning a career move, or steering a business, the same principles of scarcity, trade-offs, and incentives apply. The price system signals where resources are tight or abundant. Strategy aligns capabilities with market realities. Finance converts savings into investment and spreads risk across time. Tie these threads together, and a clearer picture emerges: navigating the economy is not about predicting every wave, but about piloting with steady hands and good charts.

Practical takeaways for different readers:

– Consumers: Track the categories in your budget with the most volatile prices. Where demand is elastic—entertainment, dining out—flex spending when needed. For essentials, build small buffers by buying nonperishables on promotion and improving energy efficiency at home. Compare total cost of ownership for big purchases rather than focusing on sticker price alone.

– Workers: Treat skills as a portfolio. Blend enduring capabilities (communication, problem-solving) with evolving technical skills relevant to your field. Seek roles and projects that expand optionality—exposure to new tools, cross-functional teams, or client-facing work that sharpens insight into demand.

– Entrepreneurs: Choose a strategic posture that matches your strengths and your market. Validate customer pain points early. Monitor unit economics obsessively: variable costs, contribution margin, and cash conversion cycles. Prepare for shocks with liquidity reserves and supplier diversification. Learn from small experiments to avoid large, irreversible mistakes.

Shift from reacting to anticipating by watching a few high-signal indicators: employment trends, purchasing manager surveys, inventory-to-sales ratios, and credit conditions. These do not guarantee outcomes, but they offer early clues to the direction of travel. Pair the indicators with on-the-ground observations—customer inquiries, lead times from suppliers, and service levels in your own operations.

Finally, let patience be part of your plan. Compounding in skills, relationships, and capital is steady rather than dramatic. A modest improvement sustained across months and years often outperforms a burst of intensity. In a world of complex systems, incremental progress guided by clear principles is a reliable advantage. The economy will continue to ebb and flow; with a disciplined approach to prices, strategy, and finance, you can move with the current and reach the destinations that matter to you.