Exploring Business: Business strategies and market insights.

Why the Economy Matters: Introduction and Article Outline

The economy is the quiet stagehand behind every transaction, job offer, mortgage rate, and checkout receipt. Even when we are not watching, it is moving props and adjusting lighting so that businesses can perform and households can plan. Understanding the economy does not require a degree in econometrics; it demands curiosity about how prices, wages, money, and markets interact. When leaders and learners grasp these mechanics, they make wiser choices—whether that means setting a product price, negotiating a salary, or deciding between renting and buying equipment.

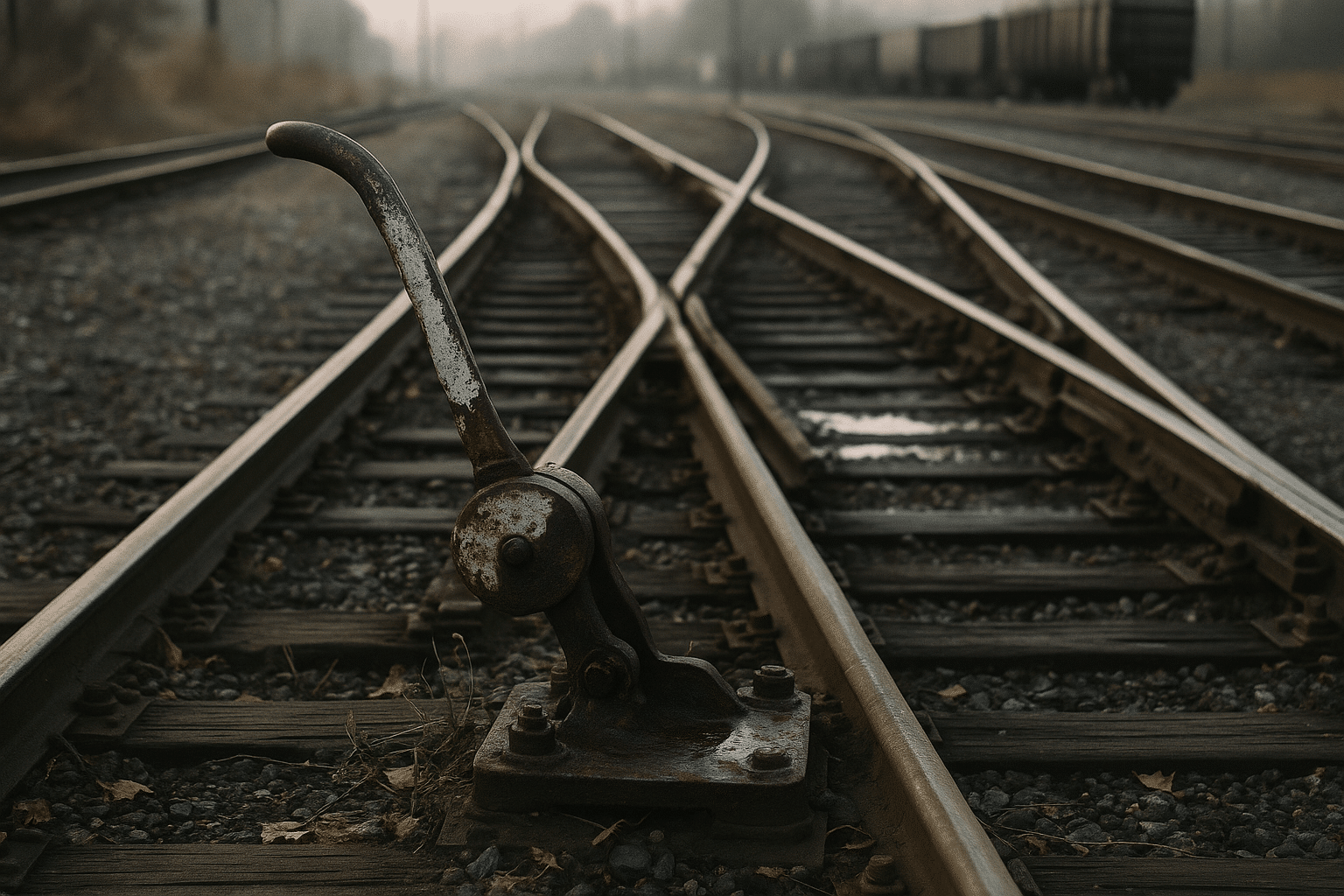

This article is a practical guide to connect big-picture trends with on-the-ground decisions. It blends market structure insights with finance fundamentals and macroeconomic indicators, so readers can navigate uncertainty with more confidence and less guesswork. From time to time, we shift from charts and ratios to imagery and narrative: think of the economy as an ocean with changing tides. You cannot command the sea, but you can trim your sails, plot your route, and choose your harbor strategically.

Outline at a glance:

– Section 1 frames why the economy matters and maps the journey.

– Section 2 explores market structures and competitive strategy—how rivals, suppliers, and customers shape pricing and profits.

– Section 3 turns to finance and cash flow—how money moves through a business and what to do when it moves too slowly.

– Section 4 decodes macro indicators—how inflation, interest rates, and cycles filter into costs, demand, and investment timing.

– Section 5 concludes with an action-oriented summary for entrepreneurs, managers, and students.

Why this matters now: volatility is not an event—it is a feature. Input prices swing with geopolitics and weather, borrowing costs react to policy decisions, and consumer confidence can pivot on headlines. In this environment, organizations that link market observations to disciplined financial decisions tend to endure. They are not necessarily larger or louder; they are more prepared. They build pricing strategies on real competitive conditions. They manage cash conversion with intent rather than habit. And they treat economic indicators like navigational beacons—useful for bearing and course correction, but never the only instrument on the bridge. If you are seeking a clear, grounded way to think about business and markets, the pages ahead are designed for you.

Market Structures and Competitive Strategy: Competing for Profitable Demand

Every market has a shape. That shape—how many rivals, how differentiated their offerings are, how easily customers can switch—determines pricing power and, by extension, profitability. A local produce stand may face many sellers with near-identical goods, so price competition is intense. A specialized industrial component maker can command more stable margins because switching suppliers imposes real risks for buyers. Recognizing which world you inhabit is the first strategic step.

Consider the spectrum:

– Fragmented competition: Many sellers, low differentiation. Price matters most, scale and operational efficiency drive survival.

– Differentiated rivalry: Many sellers, meaningful uniqueness. Branding, service, and niche features create room for margin.

– Concentrated markets: Few sellers, high barriers. Contracts, regulation, and capital intensity stabilize pricing.

– Platform-like dynamics: Network effects make the product more valuable as more users join, raising switching costs over time.

Strategy begins by mapping your position. If buyers can switch with a click and suppliers can raise input costs quickly, your pricing latitude narrows. In such cases, emphasize speed, cost discipline, and micro-differentiators (faster delivery windows, flexible packaging, proactive customer support). Where differentiation is credible—say, a patented process or a compliance advantage—price can reflect value without inviting a destructive race to the bottom.

Practical tools:

– Five-forces style assessment: Buyer power, supplier power, rivalry, new entrants, and substitutes. Score each from low to high and revisit quarterly.

– Willingness-to-pay testing: Pilot price changes with small cohorts to detect elasticity. Track conversion and churn before rolling out broadly.

– Switching-cost design: Offer data migration, training, or interoperability that makes your solution sticky without trapping customers unfairly.

– Cost-to-serve analytics: Not all revenue is equal. Identify orders that consume disproportionate service time or freight.

Risk management belongs inside strategy. In markets with volatile inputs, hedge selectively and build clauses that adjust prices with transparent indices. In fast-moving consumer segments, shorten planning cycles and maintain a test-and-learn cadence. Importantly, align incentives: sales teams rewarded purely on volume can undermine price discipline, while procurement focused only on immediate savings can raise total cost of ownership. The goal is not to “win” every deal, but to earn profitable demand consistently. That requires knowing the shape of your market and shaping your offer accordingly.

Finance and Cash Flow: Turning Revenue into Resilience

Revenue is applause; cash is oxygen. A company can grow sales and still run out of money if cash conversion lags. Finance is the craft of turning promises into liquidity, risk into return, and plans into numbers that withstand reality. The most universal building block is the cash conversion cycle—how long it takes to turn cash spent on inputs into cash collected from customers. Three levers matter: days inventory outstanding, days sales outstanding, and days payables outstanding.

Working capital moves often hide in plain sight:

– Inventory: Rationalize assortments, forecast with rolling demand signals, and segment by velocity. Fast movers demand availability; slow movers deserve stricter reorder points.

– Receivables: Offer early-payment incentives where margins allow, tighten credit terms for higher-risk accounts, and automate follow-ups to reduce “forgotten” invoices.

– Payables: Negotiate terms aligned to your own cash cycle. Honor commitments to preserve supplier relationships—prioritize transparency over unilateral delays.

Capital structure is the second pillar. Debt amplifies outcomes: it can lower the weighted average cost of capital up to a point, but too much leverage throttles flexibility when conditions tighten. Equity cushions shocks but dilutes ownership. The right mix depends on earnings stability, asset tangibility, and growth horizon. Sensitivity testing helps: if revenue dips by a modest percentage, do covenants remain intact? If rates rise by one or two percentage points, does coverage still look comfortable?

Investment appraisal translates strategy into financial discipline. Use conservative hurdle rates that reflect time, risk, and alternative uses of cash. When evaluating a project, complement net present value with payback period and a qualitative risk register. Ask: Are assumptions reversible? Can we stage the investment with go/no-go gates? Can we pilot with a small customer set before scaling?

Finally, finance is a storytelling language. A clear monthly narrative—what changed in price, volume, mix, cost, and timing—grounds decisions and builds trust. Close the loop with operational teams: procurement sees supplier pressures early, sales hears customer rumblings first, and service teams detect dissatisfaction before it becomes attrition. When financial data meets frontline insight, leaders act sooner and with more precision. That is how revenue becomes resilience rather than strain.

Macroeconomic Indicators: Reading the Currents Beneath the Waves

Businesses do not operate in a vacuum; they breathe the air of inflation, interest rates, exchange rates, and employment trends. These indicators are not trivia for economists. They are early warnings for cost pressures, demand shifts, and capital availability.

Inflation is the rate at which general prices rise. Persistent elevation erodes purchasing power and compresses real wages if pay does not keep up. For businesses, inflation matters through two lenses: input costs and pricing power. If your inputs are commodities with volatile quotes, consider diversified sourcing, long-term contracts pegged to public indices, or modest hedges that limit downside without speculative exposure. On the pricing side, smaller but more frequent increases can be more acceptable to customers than infrequent large jumps—especially when paired with transparency about drivers.

Interest rates are the price of money. When policy makers raise benchmark rates, borrowing costs generally climb, affecting mortgages, equipment leases, and revolving credit. Projects with marginal returns may no longer clear the hurdle. Practical responses include:

– Reprioritize investments: Fund initiatives with clear, near-term cash paybacks.

– Fix exposure thoughtfully: Consider fixing portions of variable-rate debt while preserving some flexibility.

– Build contingency buffers: Maintain liquidity reserves sized to your cash burn and revenue variability.

Employment and wages influence demand and cost simultaneously. Tight labor markets raise wages and intensify competition for skills, but they also support consumer spending. If your model relies on specialized labor, invest in retention: training, predictable scheduling, and career paths often cost less than chronic turnover. If automation can relieve bottlenecks without sacrificing quality, pilot it where processes are stable and volumes justify the spend.

Exchange rates matter if you buy or sell across borders. A stronger domestic currency cheapens imports but can make exports less competitive. Rather than guessing currency moves, align costs and revenues in the same currency where feasible, and time large purchases when forward curves are favorable. For budgeting, build scenarios—not just a single plan. Set bands for inflation and rates, and predefine actions if thresholds are hit: adjust prices, delay nonessential capex, or expand supplier bids.

The aim is not to predict perfectly; it is to prepare sensibly. By monitoring a compact dashboard—consumer sentiment, inflation trend, short- and long-term rates, commodity baskets, and job openings—you give yourself permission to act early, which is often the difference between a controlled adjustment and a scramble.

Conclusion: A Practical Playbook for Leaders and Learners

For entrepreneurs building something from scratch, for managers steering established teams, and for students eager to translate theory into action, the economy is both context and catalyst. Markets define how hard you must work to earn pricing power; finance converts ambition into endurance; macro forces set the weather that all vessels must sail.

Carry forward a compact playbook:

– Know your market’s shape. Map rivalry, switching costs, and barriers. Choose strategies consistent with reality, not aspiration.

– Make cash flow a habit, not a quarterly panic. Shorten the cash conversion cycle with disciplined inventory, receivables, and payables management.

– Treat indicators as instruments. Watch inflation, rates, and labor trends. Preplan responses to threshold events rather than improvising under stress.

– Narrate the numbers. Build a shared language across finance and operations so that signals turn into timely decisions.

None of this demands heroics. It asks for repetition: revisit your five-forces assumptions, refresh pricing experiments, rerun sensitivity tests, and update scenarios as fresh data arrives. Over time, modest, consistent adjustments compound into durable advantages. When the tide turns—and it always does—you will have trimmed your sails, lightened your load, and charted a route that respects both opportunity and risk.

Above all, remember that economic understanding is practical. It shows up in the choice to delay a marginal project, to trial a smaller product launch, to lock in a key supplier at a fair and transparent price, or to add a week of liquidity cushion before it seems necessary. These are the quiet decisions that rarely make headlines but often decide outcomes. If you keep one image from this article, let it be a seasoned navigator scanning the horizon—respectful of the weather, anchored by instruments, and confident in the vessel because preparation has already done much of the work.